How Important Are Ad Demand Sources To Total Ad Revenue?

One of the most commonly misunderstood and mysterious elements of publishing is the ad ecosystem. The lack of transparency only adds to the trouble that publishers often have in understanding exactly what ads are showing on their sites, what they are being paid for those ads, and what the difference in revenue might be depending on where the ads are actually coming from.

“Where the ads come from” could be considered a simple definition for the term ad demand sources. For many, ad demand sources are often thought of as one of the most important factors for how much a publisher might be able to earn from ads on their site.

But, is this true? And if it is, how much of an impact does it make on total site earnings?

Unfortunately, while ad demand can make an exponential impact on total ad revenue, there is a huge lack of understanding among publishers, bloggers, and website owners about exactly where that impact comes from and what it looks like.

Below, I’ll simplify this dynamic and try to make it so everyone can see exactly how this all works.

What are ad demand sources?

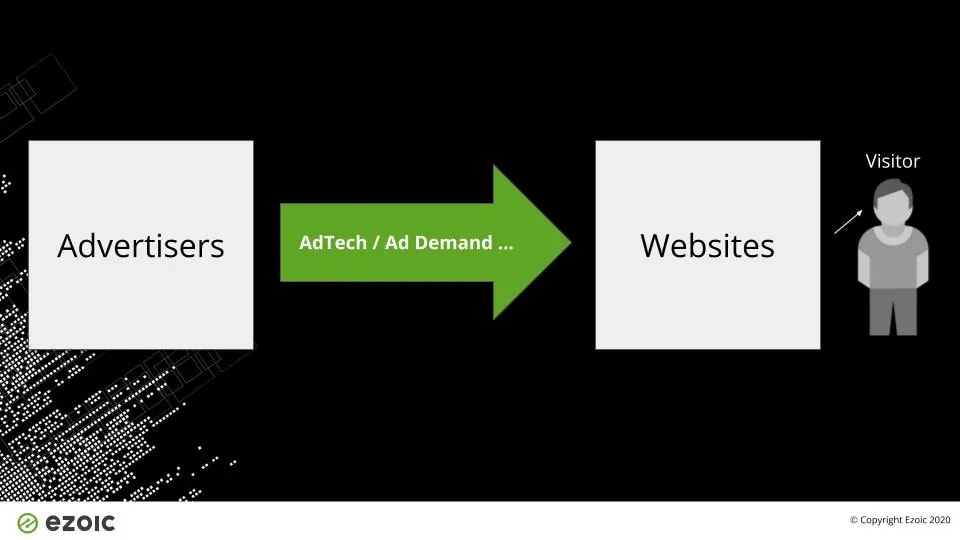

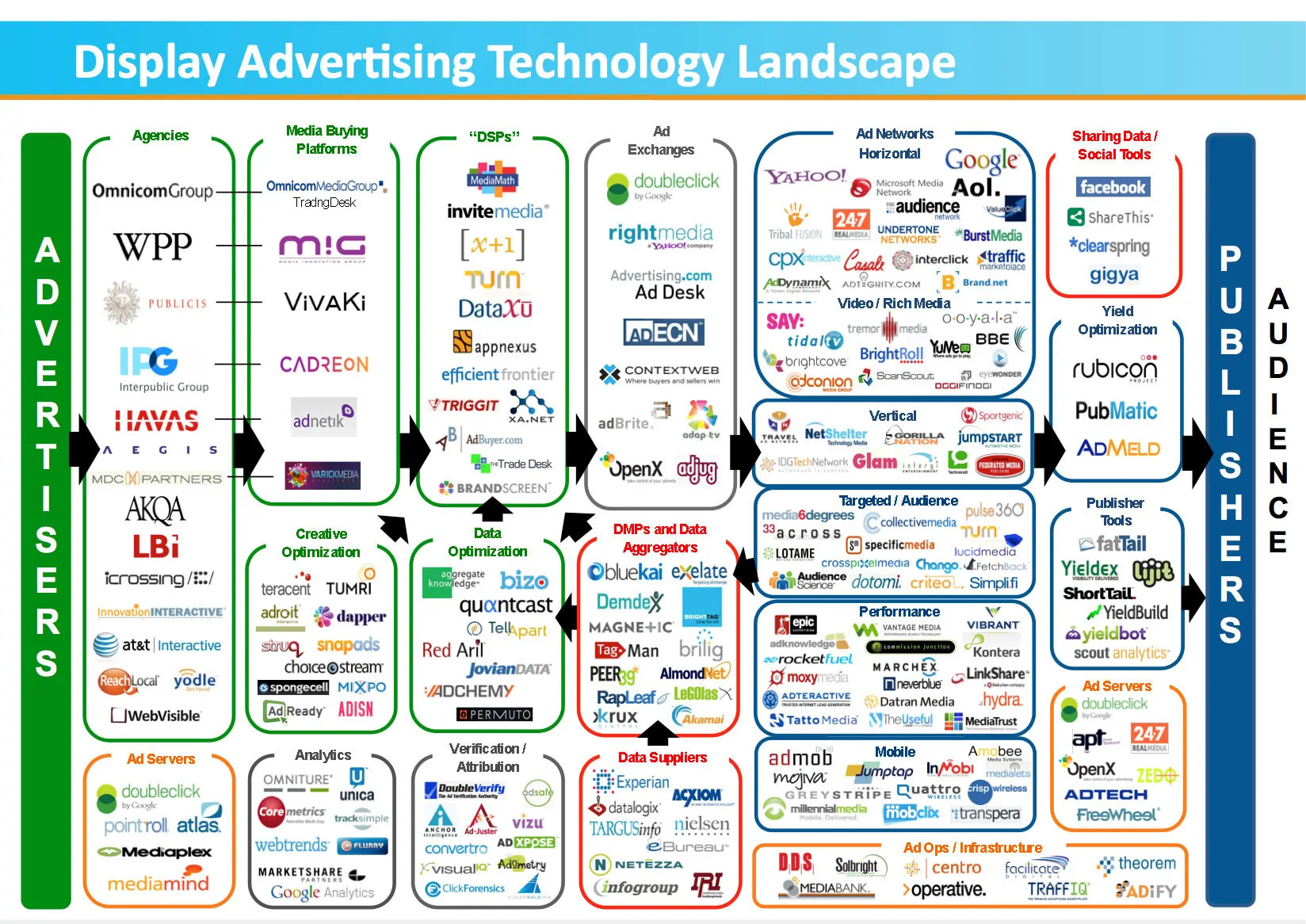

Ad demand sources can essentially be lumped into 3 categories; ad networks, ad exchanges, and direct deals. These demand sources vary in type and function. This is a bit of a simplification, but for the sake of making things easy, this is how we can think of it.

- Ad Networks: There are thousands of these (AdSense being the biggest, and others like Media.net, Propeller Ads, etc.)

- Ad Exchanges: There are less than a dozen or so of relevant ones (Google’s AdExchange, AppNexus, OpenX,)

- Direct/Private Deals: These are advertisers that work directly with publishers to advertise on their sites (through direct relationships or programmatic private marketed places [a PMP deal], etc. etc. etc.)

But… those are just a few of the parties that actually sit between advertisers (looking to get their ads in front of people) and publishers (websites that display ads for money).

What you see above is referred to as “adtech”. While not inherently good or bad, adtech is partially responsible for the lack of transparency in digital advertising. Fortunately, many of the parties embedded here are adding value to everyone. Unfortunately, many are not.

Ad demand sources are included in this picture and play a role in how the ad dollars make their way down to the publisher.

What’s the difference between ad demand types?

The first ad networks popped up during the dotcom boom that started in the mid-’90s. They were used to help scale relationships between advertisers and publishers (as they could not all feasibly build one-to-one relationships).

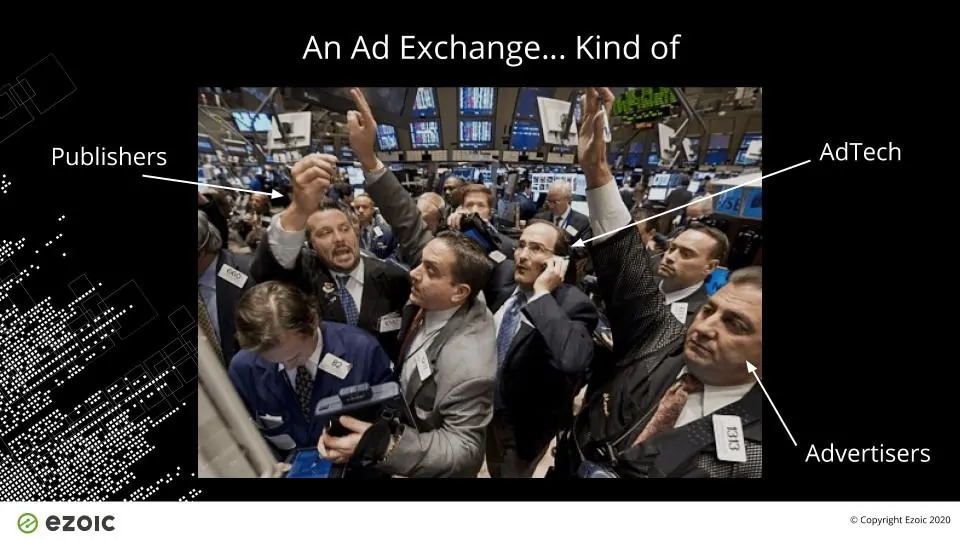

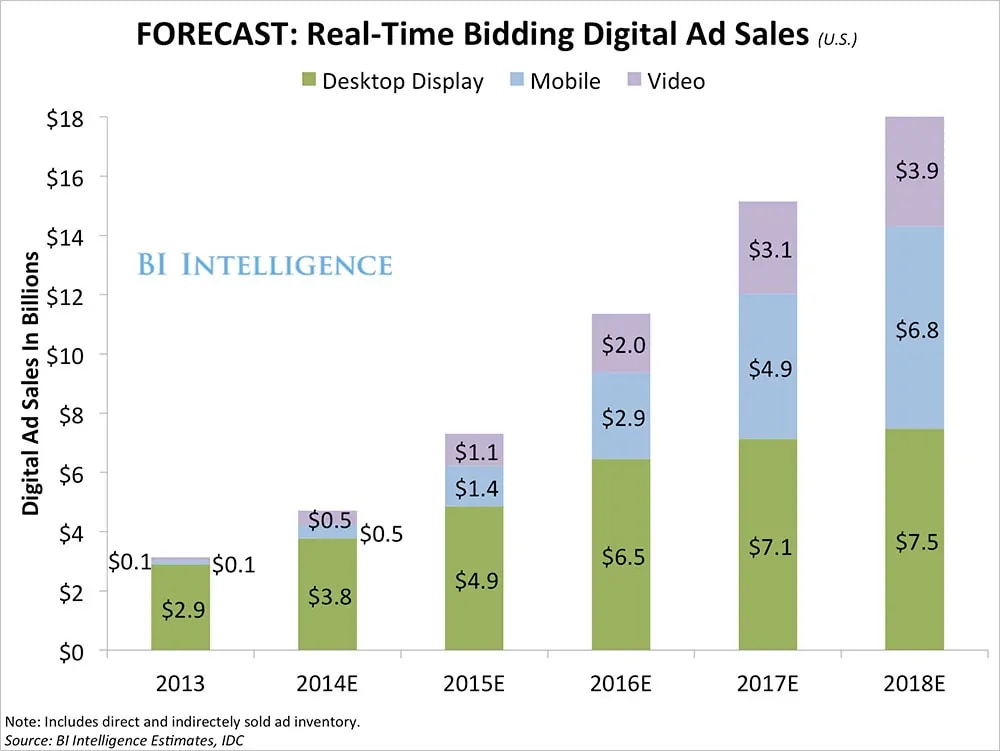

Ad networks in the 2000s would manually adjust pricing based on supply and demand (like the photo above). This process changed to an automated price based on a real-time price (real-time bidding) — which was the start of ad network decline and the beginning of ad exchange emergence as the most efficient way of determining price.

The rise of ad exchanges also gave birth to the modern “ad server”.

What is an ad server? An ad server in its purest form is a technology digital publishers and advertisers use to buy and sell ad inventory (available ad space).

How do ad exchanges work? Ad exchanges are almost like a Wall Street trading floor. The simple idea is that ad exchanges are an open playing field where advertisers, publishers, networks, and intermediaries can all participate in the buying and selling of ad inventory (ad placements).

DoubleClick became the most popular ad server that acted as a digital medium for ad buying and selling. They survived the dotcom bust of 2000 and Google bought it in 2007 for $3.1 billion (it was referred to Google DFA/DFP until 2018 when Google changed the name to Google Ad Manager and included their industry-leading ad exchange in the product itself).

Today, there are several large ad exchanges and thousands of ad networks. Google’s Ad Exchange is still the largest – and by all accounts and research – the one responsible for far more revenue collected by publishers than any other.

Publishers can also sell directly to advertisers using the same technology that is used to buy/sell ads programmatically through exchanges. Google Ad Manager allows publishers to set up private deals where they can set aside a portion of ad space just for direct relationships/buys from specific advertisers.

In a private deal, a publisher may have someone like Apple reach out and want to order a specific set of ads for a set number of impressions over time. Apple could set this deal up themselves in a marketplace created by the publishers, or the publisher could set it up by having an employee “traffic” the deal once it was ordered.

Is the ad demand responsible for ad targeting (what ads show to who…)?

Basically, yes.

Ad demand, and various marketing and advertising technologies, ultimately determine how advertisers reach their audience and for what cost. If a visitor comes to a website and sees an ad for Nike shoes the ad demand sources and ad technology used by a specific advertiser (in this case, Nike) are the mechanisms responsible for buying and serving that ad to the user.

Unfortunately, there is a bit of an uneven chain in how this works between advertisers and publishers. Advertisers are traditionally very good at understanding the value of people they are targeting; while publishers often lack the data needed to price each visitor differently and customize their inventory to maximize their total earnings.

Ad demand sources do not control the value (or worth) of the ad space (inventory) a publisher is selling. They can simply provide a price that an advertiser is willing to pay for a visitor based on historical site data that is collected in the real-time bidding protocol (in cases of programmatic advertising).

So, do ad demand sources determine how much a site can earn from ads?

In part, yes. Ad demand is responsible for the number of advertisers and would-be bidders that have access to a publisher’s website inventory (as space). More competition is typically good for bidding environments. An auction that has lots of bidders is more likely to see higher prices reached, right?

Ad demand is not responsible for the value of the inventory a publisher is selling though. The visitors on a particular site are what is inherently valuable to advertisers and ultimately what determines what advertisers are willing to pay inside of exchanges, networks, etc. for ad space on a website.

Ultimately, ad demand can account for a certain amount of potential, but even with header bidding set up and access to Google’s dominant ad exchange (and its massive number of bidding partners), a publisher’s total website earnings from ads will be determined more by the historical value of their audience than ad demand sources.

You can read more about how publishers can build the value of their ad space here.

The misunderstood value of user experience and the value of inventory over time

While ad demand sources can help with the competition, it is ultimately the audience that advertisers are bidding on. Even if an audience may not be a great geographical or demographic target for expensive products or services (meaning they would attract high-paying advertisers), and engaged audience is still valuable.

On the flip side, even an audience from a traditionally high-paying geographical or demographical profile could be of little value to advertisers if they aren’t engaged in the site’s content.

Why?

Engagement is a proxy for campaign performance. Ad viewability, CTR, clicks that result in someone buying something, and a lot of other potential goals will determine if an advertiser is seeing ROI on their campaign.

Visitors that are flooded with ads or disengaged with content (low time on page, high bounce rates, etc.) are often less likely to complete these things. Over time, advertisers adjust bids to account for this.

This principle means that user experiences provide an inherent value in determining how much a publisher or website is paid over time for ads — no matter if they have an audience from a traditionally high-paying demographic or not.

This is something that a demand source CANNOT INFLUENCE. User experience is seen as being ‘fixed” and not something that can be changed. This is why Ezoic’s measurement of Engagement Time is directly related to long-term ad rate performance.

If visitors slowly become less engaged in a site – because of a new widget let’s say – this will not immediately impact website revenue. It will be impacted in the following months or weeks as advertisers slowly adjust their bids to account for decreasing campaign performance KPIs (key performance indicators).

Are more demand partners better than fewer?

More demand partners are better than fewer demand partners— no doubt about it. More partners equal more competition. We touched on this above.

Some ad management shops rely on demand to equalize (the ad demand will ‘sort itself out’). They ‘stack the ads high and sell them cheap’ – relying on sheer ad numbers to make up for the lower prices.

Putting ads on all pages (in all circumstances) damages UX. Publishers need to watch their data carefully to ensure they don’t damage user experiences — and long-term ad inventory value.

Ad demand source optimization is just one aspect of a much larger optimization problem.

But, where is the point of diminishing returns?

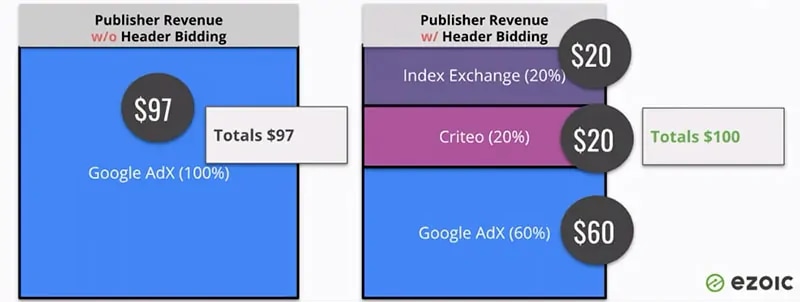

If Google’s AdX (ad exchange) wins the majority of bids but still loses 5% of the time, that 5% is still a 5% difference, right?

Correct.

However, 5% doesn’t mean that winning bidders are winning and creating 5% higher revenue. They are winning bids in this example only 5% of the time. Typically, winning by a very small amount.

Header bidders, or other demand sources in this case, may be beating Google AdX 5% but by only 5%of the total bid amount. This means that it only increases 5% of the revenue by a very, very small amount (5% or less). So, 5% improved by less than 5%.

You can see in the simple example above how having multiple demand partners increases revenue by around 3%. Over time, for that 3%, there is a myriad of things you have to manage from each demand partner. If you have the time and the resources to be able to manage multiple demand partners, then that route might make sense for you.

- Bid request latency

- Separate payment/management

- Setup and implementation

- Future requests

- Potential for bad ads

But, the value of this increase is distorted by the “win” ratio.

RECAP EX: Partner X wins 5% of the time. 5% doesn’t mean 5% more revenue.It just means that they marginally win 5% of all bids. Even if they win by 10% on 5% of inventory, that is only a 0.5% improvement in revenues.

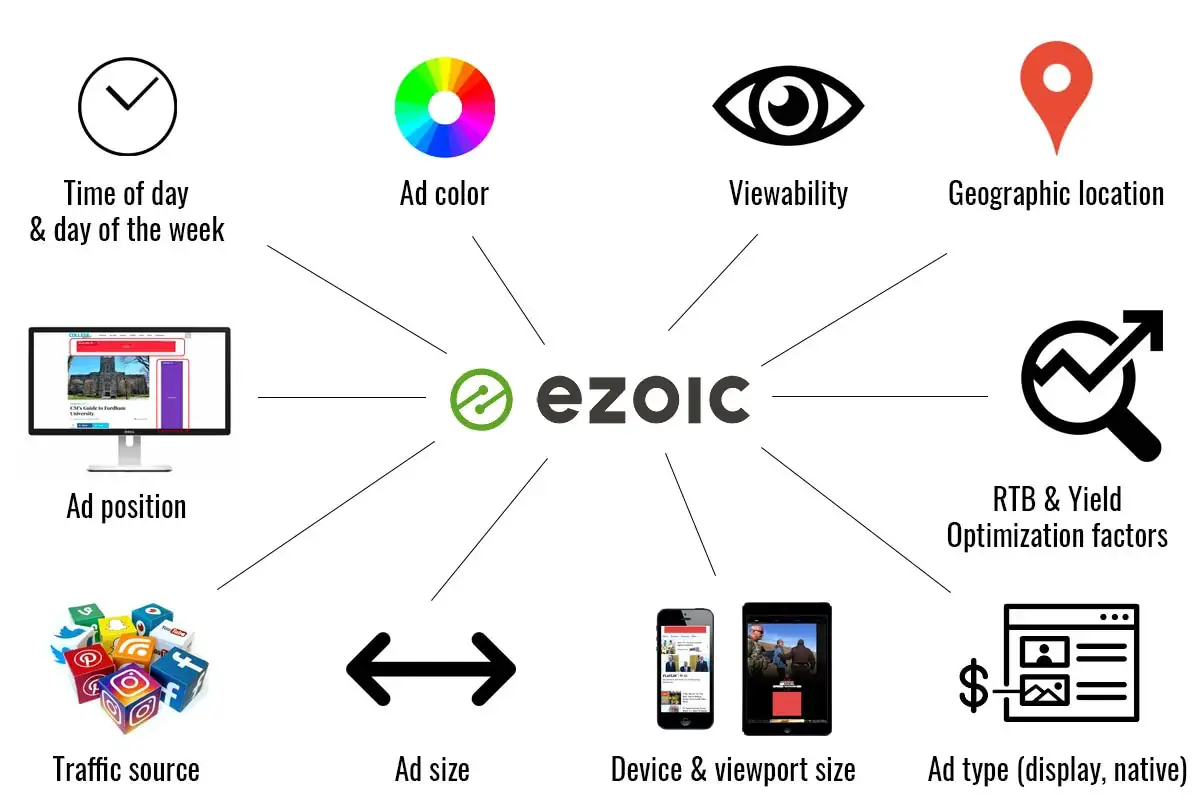

TL;DR (or you didn’t follow the math): Just looking at ad demand optimization is unlikely to move the needle on your earnings because there is so few sources of truly unique demand. By adjusting a multitude of site variables such as ad location, ad size, ad formats, navigation features, site layouts, content distribution and site speed – you can make incremental improvements to UX and revenue at the same time.

Will having more demand partners become more or less relevant?

Having more demand partners will become less relevant because of the fact that Google switched to a first-price auction for Google Ad Manager. In a first-price auction, the highest bidder pays that price. Second-price auctions pay the second-highest price plus one penny; Google was one of the only players in the space that used this model.

This change will probably make it to where AdX will win more bids and adding additional demand partners will become less important for publishers. This simply means that it will become less likely that unique partners or demand sources will win with enough frequency to be worth the time and energy of managing these relationships.

How different is the ad demand between partners, publishers, etc.?

Realistically, not that much different. Anyone with a decent header bidding setup, access to Google AdX, and a working AdSense account will be competitive against just about any publisher, ad ops pro, or partner setup.

Many will disagree with this, and there may be a number of caveats to this, but speaking purely of where the ads come from, this is largely true.

Using Ezoic, you can easily access all of this ad demand and more right away (no setup, or additional account applications). You can also add in any existing ad relationships you want to “plug in” to Ezoic as well.

What methods can increase ad revenue beyond demand sources?

To demonstrate how the future of digital publishing will drift away from attempting to increase ad revenue solely through targeting and move toward a more holistic approach, I’ll reference a popular magic trick website.

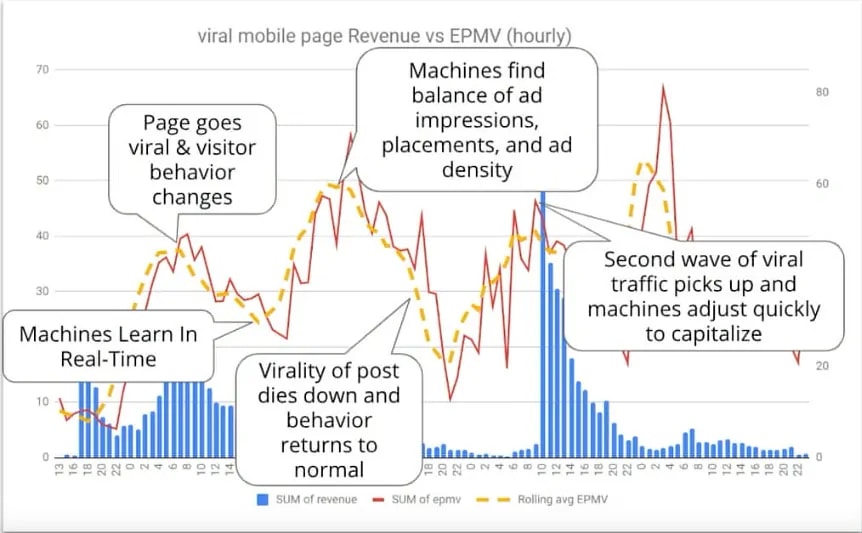

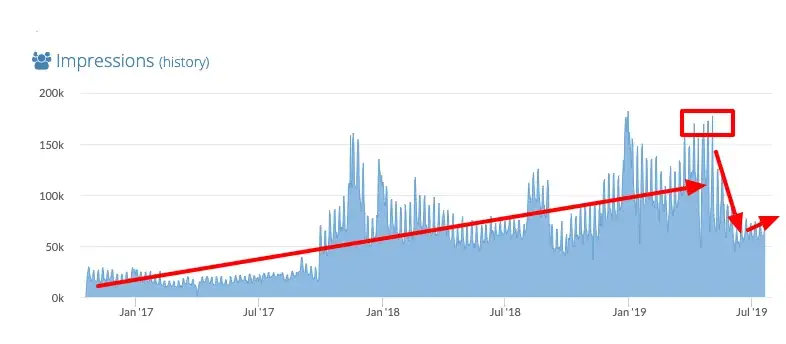

One day, they had two different posts that went viral. The chart for the day is below.

This site used Ezoic to allow machines to adjust ad inventory (ad placements, density, etc.) per visitor to maximize the value of each visit.

When the first post goes viral, visitor behavior changes because a lot of the new traffic is coming from social (where the posts were both posted), and machine learning uptakes that new information in real time. The machines are trying to find an optimal balance of ad impressions, placements, and ad density.

When the second wave of viral traffic picks up, the machines adjust quickly to capitalize. Since it had the visitor data from the first spike, it used the information to better optimize for future visitors and increase engagement and subsequently ad revenues. This brings me to my first method to take a more holistic approach to ad revenue.

Here’s how you use this info to make more money if you’re a publisher…

1. Look at EPMV and not CPM/RPM

If you’re a loyal follower of the Ezoic blog, you know this piece of advice is a topic we’ve written about frequently. EPMV (Earnings per thousand visitors) is the most effective way to tell if your site is actually earning more revenue from the same amount of traffic than they were before.

What’s great about EMPV in comparison to a metric like RPMs or CPMs is that it’s not diluted by pageviews or the total amount of ads on the page. EPMV looks at the value of all the ads from an entire visitor session.

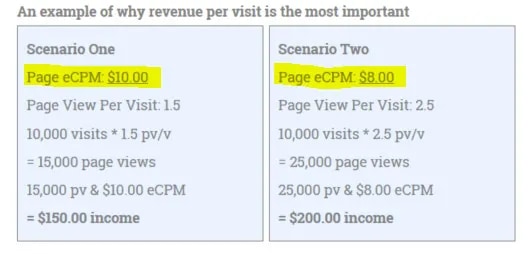

The above example demonstrates how a site with a lower page eCPM(RPM) still earns more revenue overall.

2. See what the data says about your content

Outside of the frequent (and frequently vague) Google Core Algorithm Updates, the majority of drops in ad revenue and traffic can be attributed to either intentional or unintentional changes on the part of the webmaster. If you see a sharp decrease in your ad revenue in a short period of time, ask yourself these questions:

- Have I made any major layout changes (menu, site structure, etc)?

- Did I implement a paywall?

- Have I changed the number of ads on my sites?

- Have I changed the position of ad placeholders on my site?

What’s important is to remember that the majority of decreases in revenue on your site are due to factors beyond your control, but to avoid making mistakes below, you want to look to answers within big data analytics before you implement a future content strategy or augment old content.

Above is an example of a publisher — you can see steady growth, and then a sharp decrease in ad revenues. The publisher added a feature where users who created a free account would be able to see the site ad-free. The publisher’s most valuable visitors were their return visitors, and these visitors were the ones who were responsible for a large chunk of ad revenues, so the moment they were visiting the site ad-free, they were no longer contributing to the ad revenue.

IMPORTANT: Remember who your most valuable visitors are, and structure your site and content accordingly.

These tips will help you create a holistic view of how your site performs in the creation of ad revenue. One of the great things about Ezoic’s Machine Learning software is that it takes the guesswork out of all the different elements of your site that are almost physically impossible to multivariate test on your own, or even with a team of people.

What’s the consensus on ad demand sources?

The world of ad demand is flattening (from DigiDay). That being said, many publishers lack the resources to enable the best sources of ad demand; forcing them to hire staff or outsource these responsibilities to partners to set up things like header bidding and accessing important demand sources, like Google AdX.

Ad demand source optimization is just one aspect of a much larger optimization problem that we believe can be alleviated by looking at a multitude of site variables such as ad location, ad size, navigation, site layouts, content distribution, and ad formats, that depending on how they are manipulated, will either will contribute to the growth or stagnation of ad revenues.

I think publishers are best equipped to manage this themselves. Ezoic makes that really easy.

Questions? Leave your thoughts in the comments below, and I’ll do my best to reply.