[et_pb_section admin_label=”section”]

[et_pb_row admin_label=”row”]

[et_pb_column type=”4_4″][et_pb_text admin_label=”Text”]

Will Apple & Google Anti-Tracking Updates Affect Publishers?

Data collection and distribution regulations are constantly tightening, and it seems as if they’re only likely to become stricter. With these changes, how will Apple and Google anti-tracking updates impact the ability for digital publishers to monetize their sites with programmatic display advertising?

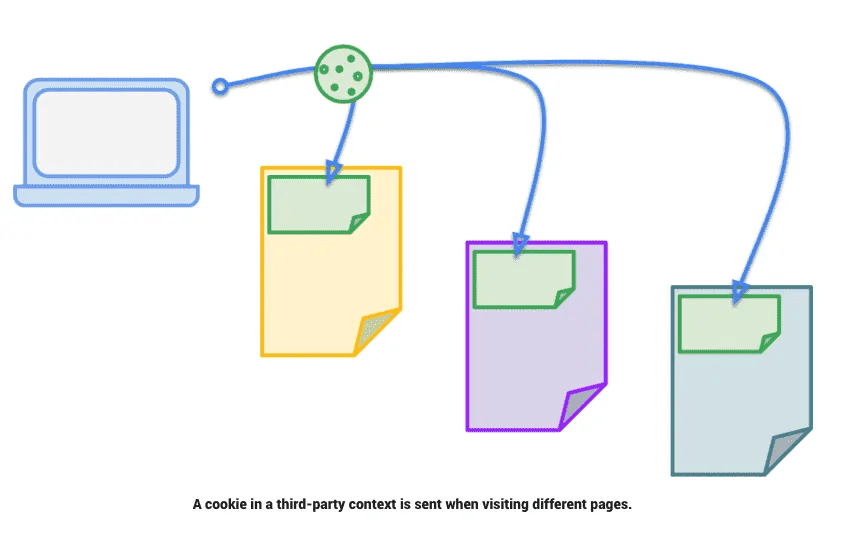

Earlier this year, Apple announced that it would be implementing Intelligent Tracking Prevention (ITP) 2.2 towards the end of March 2019 with the release of Safari 12.1. ITP 2.0 was related to third-party cookies and 2.2 focused on first-party cookies. Version 2.2 is targeting workarounds previously utilized by both Google and Facebook.

Google has been moving in a similar direction for a while. The entire industry is moving further and further away from 3rd-party data, and even some forms of 1st-party data, to provide the ecosystem with a more straightforward form of understanding what is being bought and sold between advertisers and publishers.

Below, I’ll share what this means for digital publishers and online content creators that derive the majority of their revenue from online advertising.

What is Apple ITP and when did it launch?

ITP: Apple implemented its first ITP in 2017 and since then, many companies learned to adapt to the new ecosystem through workarounds, such as storing third-party cookies as first-party cookies. One of the major effects of Apple’s ITP 2.1 was that persistent first-party cookies, or cookies that stay longer on your computer and can have a set expiration date of up to 20 years, now have a limited expiration of seven days.

The Apple ITP 2.1 update limited the ability of marketers and advertisers to track users, use cookies, and do programmatic or display advertising.

Apple’s ITP 2.2 update limits workarounds used by many inside the ecosystem by changing the previous seven days to one day.

Example latest of ITP in action: This means that if someone clicks on an ad on a Friday in a Safari browser on their phone, and returns to buy the item on Sunday morning on the same device, there will be no information to indicate that the user is visiting a second time. This also prevents the retailer from re-targeting that user beyond 24 hours via display advertising from that initial interaction on traditional programmatic networks.

Is Google’s Chrome browser update the same as ITP?

Not exactly, but they serve similar purposes.

Google recently announced that it also would move away from using third-party data. However, unlike Apple’s ITP, users will get to choose if third-party cookies are blocked. Those to be most affected by the switch are advertisers and marketers who heavily rely on third-party cookies and do not have a direct consumer relationship.

Larger tech companies, like Google and Apple, are likely to benefit.

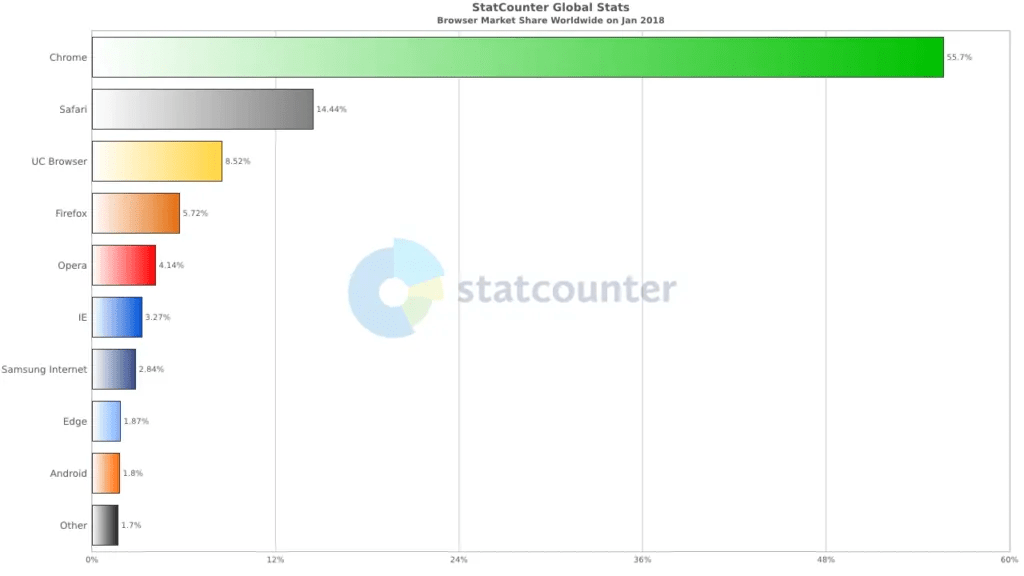

Smaller companies are not happy about the change since Google Chrome controls roughly 80% of the global market and see the change as ‘highly anti-competitive.’

Many publishers are probably wondering what this means for their programmatic and display revenue, since many advertisers and marketers rely, at least somewhat, on third-party data and persistent first-party cookies. If there are negative effects for them, won’t this trickle down into ad revenue?

Will ITP and Chrome cookie-tracking changes impact display ad revenue?

The short answer is, probably not. Good quality publishers are likely to benefit from this long-term; as advertisers will continue to find ways to reach their audiences on digital platforms.

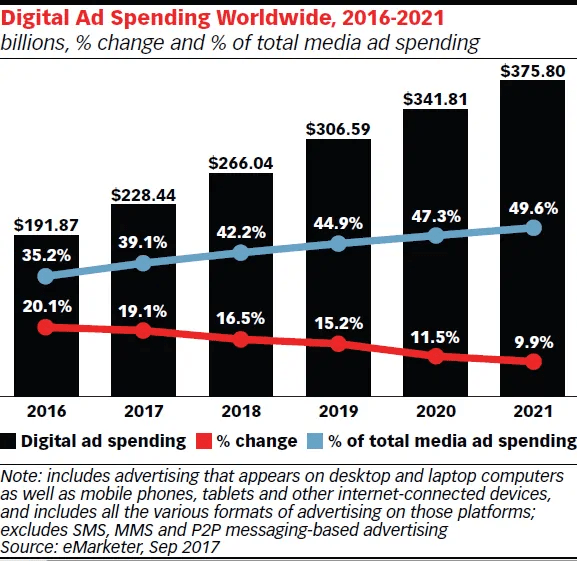

Digital ad spending is likely not going to decline. All projections show it continuing to grow. Digital advertising still offers better targeting than all other forms of advertising even if it can’t be done through traditional audience re-targeting.

This means that advertisers will still need to find ways to target audiences digitally. Just because they cannot use cookies doesn’t mean they’ll abandon display advertising. This may actually lead to higher ad rates for publishers that can prove they have a quality, engaged audience.

Below, I go over third-party and first-party data, how it affects publishers, and how you may end up benefiting from it.

What is the difference between third-party and first-party data?

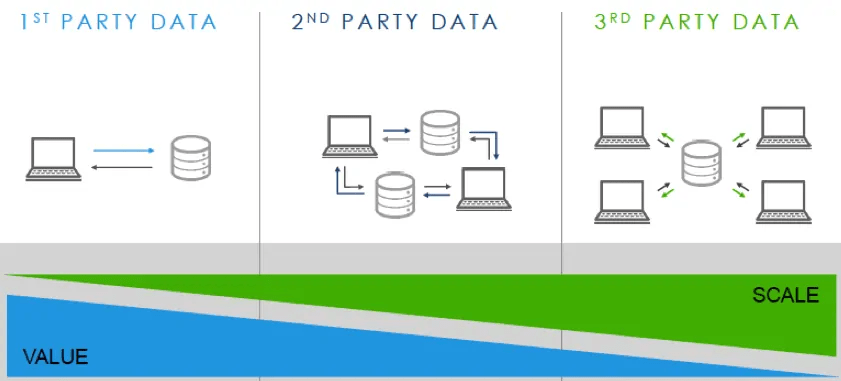

In brief, third-party data is data that is collected and sold to companies, who then use the information for advertising and re-targeting.

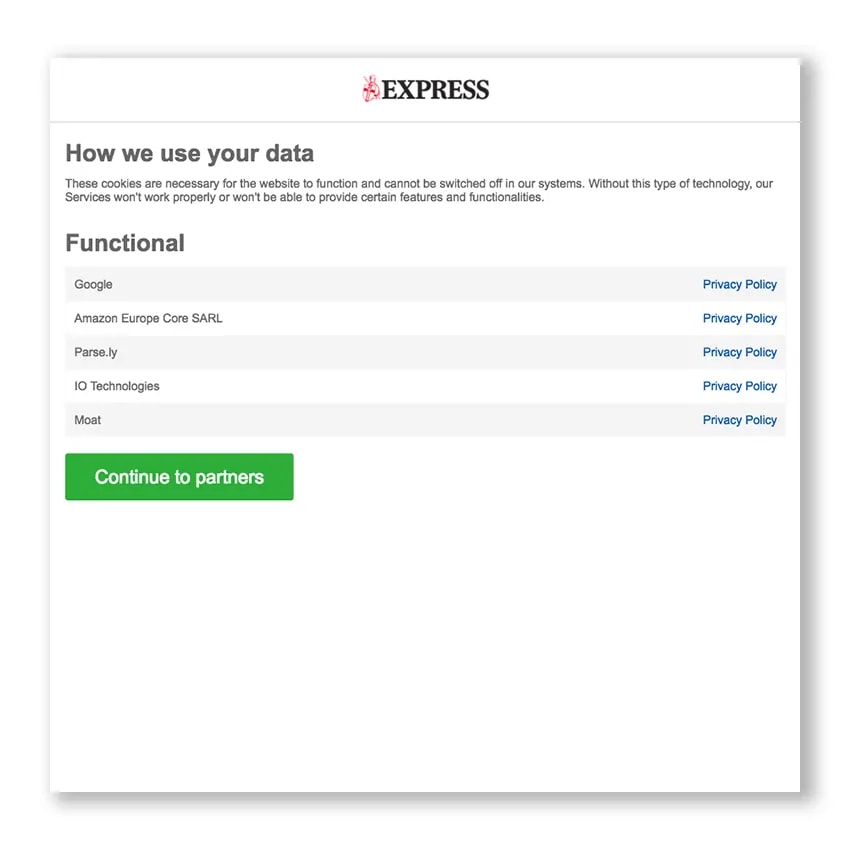

As mandated by the General Data Protection Regulation (GDPR) in Europe, users are required to select yes or no to cookies. However, in the US, if you click outside the cookies pop-up window, it assumes you approve cookies. In either scenario, transparency about cookies and data collection is vague and users often don’t completely understand what they are saying yes or no to.

First-party data is more beneficial to companies and less invasive to users and is aggregated by a small pixel added to a website and then is stored within the website’s CRM (Customer Relationship Management) or CDP (Cisco Discovery Protocol).

User’s data will still be collected but the information is specific to that website’s audience, rather than purchased from a third-party company. First-party data is generally considered the most reliable data source for making decisions on future user behavior.

How will cookies work in Google Chrome now?

In Chrome specifically, users will have the option to clear all cookies while still retaining single domain cookies. WNIP recently reported the following about Google Chrome’s latest protections coming into play with ITP implementation:

- In order to access consumers, developers will be required to specify – with attributes – which cookies contain user tracking and cross-site capabilities.

- Chrome users will be able to access this information and delete all cookies without affecting those which are active on a single domain (e.g., login, settings, site preferences).

- The browser will “aggressively restrict” fingerprinting techniques used by websites to identify browsers without a tracking cookie, though Google is vague on what this entails.

Will non-Apple and Google browsers adopt cookie regulations?

Probably so. Many already have. Even if they don’t, Apple and Google dominate so much of the browser market share that marketers, advertisers, and publishers will all be forced to adapt just to fit the needs of users that leverage the popular tools.

The ecosystem will adjust despite what other major platforms and systems do.

Amazon is poised to benefit and control this data in a similar way on its platform. It will likely impact e-commerce retailers in a much more dramatic way than publishers.

Will publishers earn more money with cookie-tracking being regulated?

While publishers often rely on programmatic and display advertising, the likelihood of Google and Apple’s switch to first-party data negatively affecting publishers is low. Additionally, high-quality publishers could likely benefit from the switch.

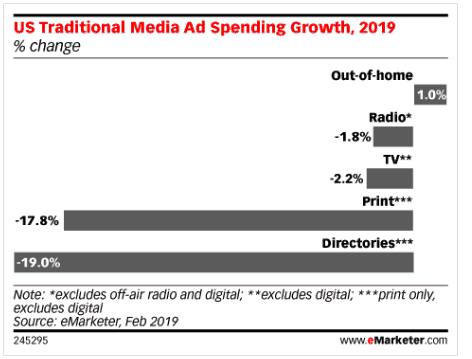

As we’ve said before, digital advertising is continuing to grow and there is no evidence to show that this is slowing down anytime soon. Spending on digital display advertising will surpass television advertising by the end of this year.

eMarketer reported earlier this year that digital ad spending will surpass television ad spending in 2019.

Money that is no longer being used on television ads will need to go someplace, even if digital display advertising becomes less targeted because of the restrictions on cookies. Though digital advertising is seeing some changes, targeting people through digital advertising is still far better than radio, television, or print.

The only major disadvantage to publishers is the changes made to persistent first-party cookies — if a user visits one day and doesn’t visit again for over a week — they will be counted as a new user once more.

While this change may seem to inaccurately represent how many unique visitors come to your site, it will likely just change the way we interpret website traffic and users. In the end, however, advertisers still need to make money, and so most of the adjustments will be on their end.

With Google accounting for the vast majority of the ecosystem, this change is actually good for Google and other platforms like Amazon. For publishers, the impact is fairly small, though the changes may lead to advertisers and marketers trying harder to work with publishers more directly or adjust the ways that they target. The main problem this may create is for advertisers and marketers who don’t have direct relationships with consumers.

How can high-quality publishers benefit?

We speculated earlier this year about engagement and the value of an audience and it seems as though everything is trending in that direction.

Marketers and advertisers will have to adjust, but high-quality publishers are still in a prime position to benefit from those ad dollars being filtered out as people try to reach their audiences.

While many publishers struggled to adapt to these types of data-collection changes when it was implemented in 2017, most have reconfigured how to effectively monetize their first-party data. While these new updates enforce tighter restrictions, most publishers have already done a lot of the grunt work on the front end getting ready for GDPR and further adjustments shouldn’t be as extensive.

The digital advertising world isn’t going away, the ecosystem in which it functions is just evolving. While these changes are certainly changing the data-collection dynamic, it generally provides users the right to choose how their data is collected and distributed.

Have any questions or comments? Leave them below and I’ll try to respond![/et_pb_text][/et_pb_column]

[/et_pb_row]

[/et_pb_section]