How To Buy A Website And Turn A Profit

My good friend John Cole has an interesting background. Once an officer of the Royal Navy (in the U.K.), John went on to run an ad network and ended up making a living buying and selling websites before helping to found Ezoic.

John recently gave a master class on how to buy a website and turn a profit at Google offices in London. The session was a part of Pubtelligence and included John’s best practices for buying web properties that are already generating revenue – not domain names, but actual sites earning money – and how to boost their revenue and turn a profit.

Below, I’ll provide the slides and a summary of John’s presentation on how to buy websites and increase their revenue.

Watch John’s presentation at Google below:

Why take John’s advice?

The session starts with John telling the story of how he got started buying websites.

It started, at first, as a financial venture, but ended as a bold new business idea.

John partnered his business with Dwayne Lafleur and the early Ezoic technology and then merged, raising Venture Capital funds from Balderton Capital. Together, they invested over $5 million dollars in web properties.

Dwayne previously had founded a company called Cubics that focused on monetizing digital apps within social networks, like Facebook. During this time, Dwayne learned that much of the ad industry had been focusing on the wrong problem.

While many were concerned about monetization and demand sources for advertising, Dwayne had learned that ad layout and position seemed to affect ad revenue far more for publishers and developers than many assumed.

This caused him to form several theories that he and John planned to test on the hundreds of website they bought.

While some of these may be well known now, many of these ideas still are not always openly acted upon, and certainly weren’t commonly known nearly a decade ago.

John and Dwayne worked together to build a technology that would essentially allow them to buy sites and then increase their revenue to generate a profit using automated technology.

They operated under 3 principles:

- Demand sources are important, but ad locations and ad density are far more important to long-term revenue and user experiences (which impact the total session revenue, not the RPM, which is actually less important).

- All ads dilute each other (meaning Google ads affect other ad demand on the page and visa versa)

- Data can objectively tell what works and what doesn’t better than the human eye or gut feel when it comes to these optimizations.

Ultimately, John shared that those ideas proved very successful. Those hundreds of sites became the tests sites for them to develop the early Ezoic technology on (8 years ago).

He claimed that they earned all their money back in less than 2 years and then turned a massive profit using the technology. He also shared that they still own almost all of the sites today and that Ezoic still uses them for testing and experimentation.

From there, John shared that he had learned a lot from these experiences and would share some of his best practices for buying and selling websites (see below).

Prior to continuing John pointed out that he was not offering investment advice.

How to buy a website 101

John believes that buying websites is a 3-part process.

First, you have to find a site that meets specific buying criteria. Then, you need to appraise it carefully. And lastly, you have to contact the owner and work out a deal.

John said it all sounds easy, but that it is filled with pitfalls and challenges.

How to find good websites to buy

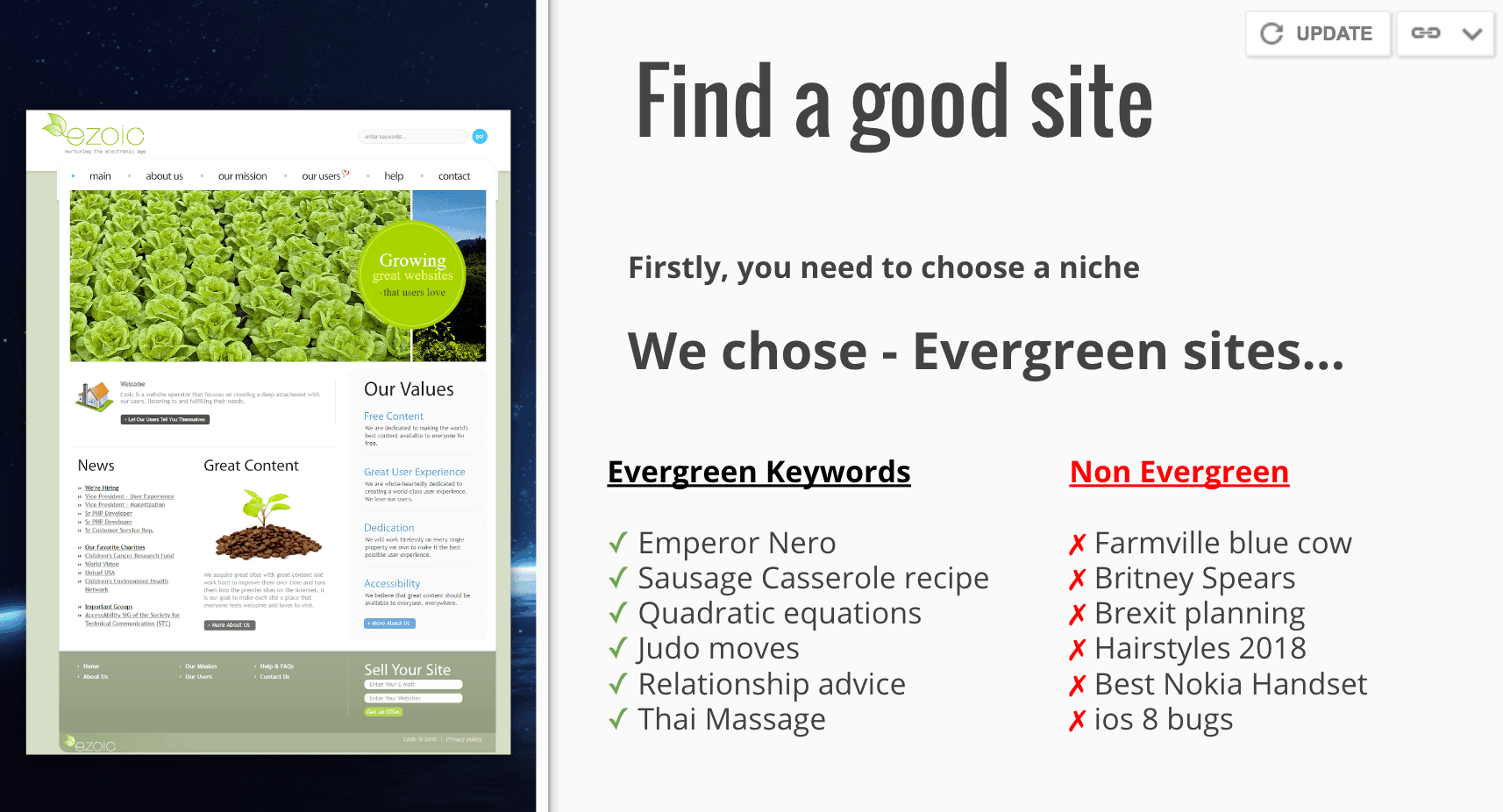

John claims that the first part of the process can often be the hardest and must start with finding the type of site that you want to buy.

He shared that they largely focused on organic traffic, evergreen websites. He said that these were often the steadiest and easiest to forecast and rely on.

Evergreen keywords relate to content that is not going to change over time. Keywords that people were searching for 5 years ago, are searching for today and will be searching for in 5 years time. He gave the example of “Emperor Nero death”. Information on that topic is unlikely to change over time and is therefore ‘evergreen’.

For John, these were important factors for buying these sites. They were going to be used to test their theories and also needed to be consistent for long-term investment purposes as well.

He said there may be situations that warrant other types of sites but that traffic sources, the site’s historical value, and other factors all needed to be thought of before looking for sites.

Tools for evaluating websites

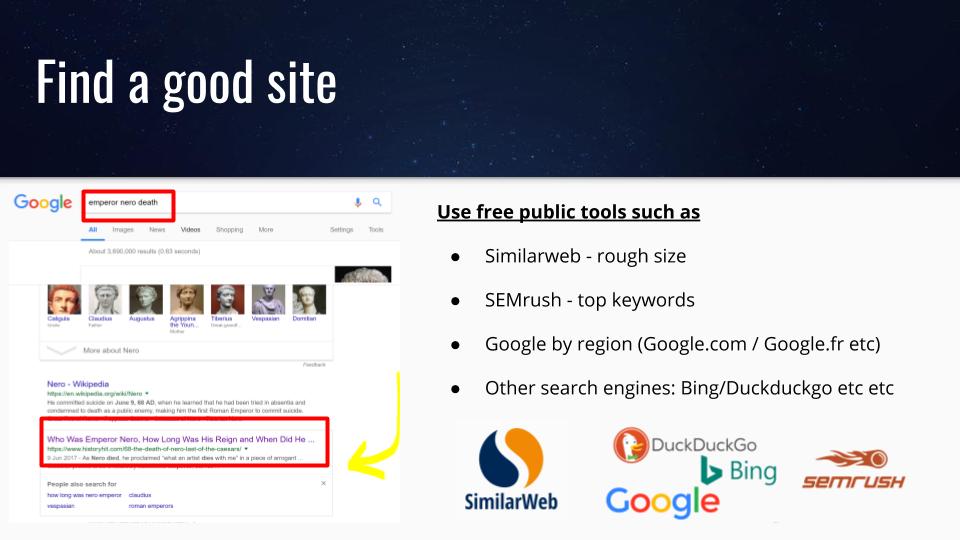

John shared several tools he felt were essential for evaluating web properties ahead of time (before contacting the owner).

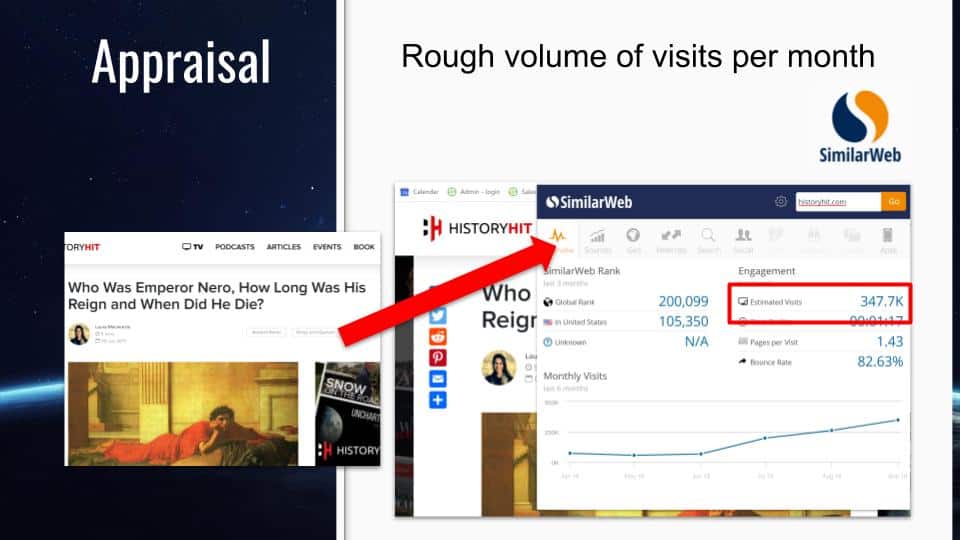

The first was SimilairWeb.

John would use SimilarWeb to get a good idea of average monthly visits, traffic sources, visitor behavior, and trends over time.

This would give him a general lay of the land and provide something he could then doublecheck later on.

He just used the Google Chrome Extension as a free tool.

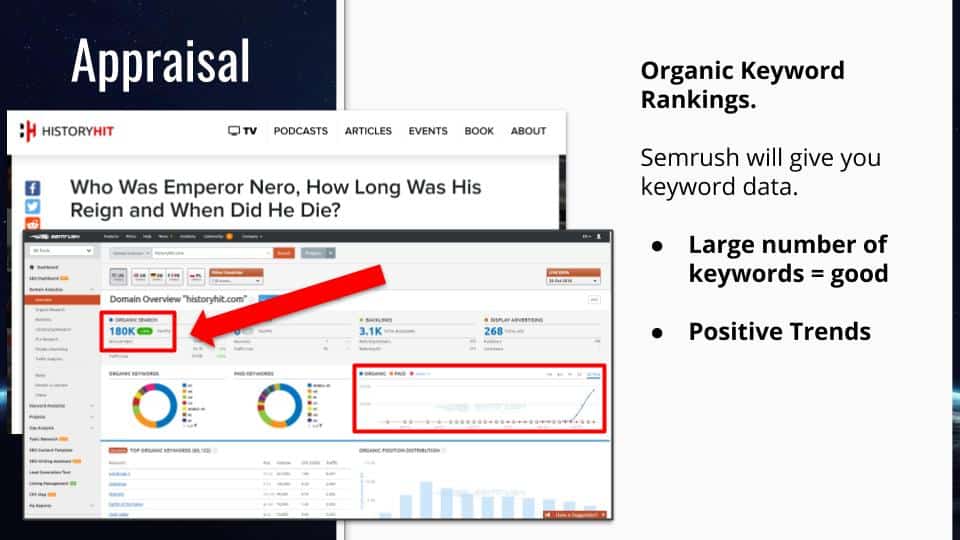

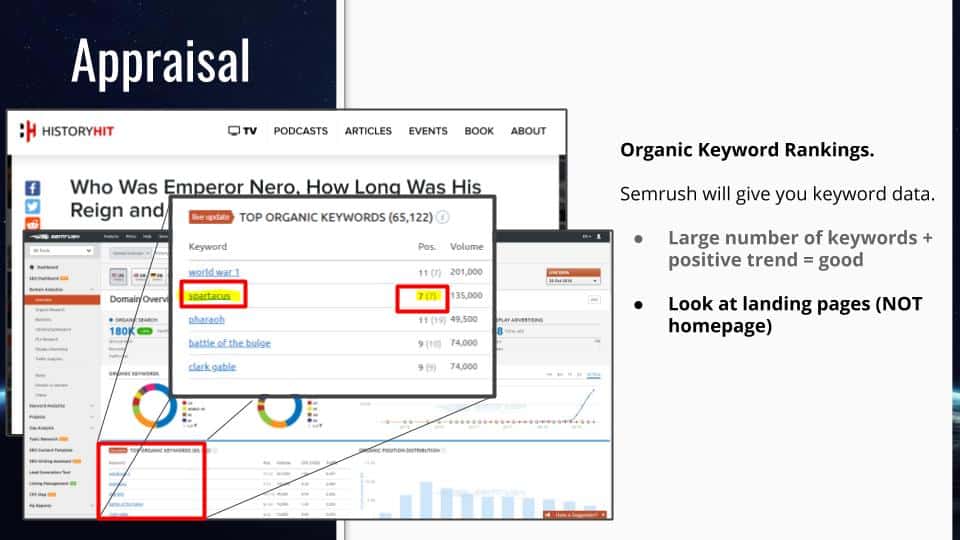

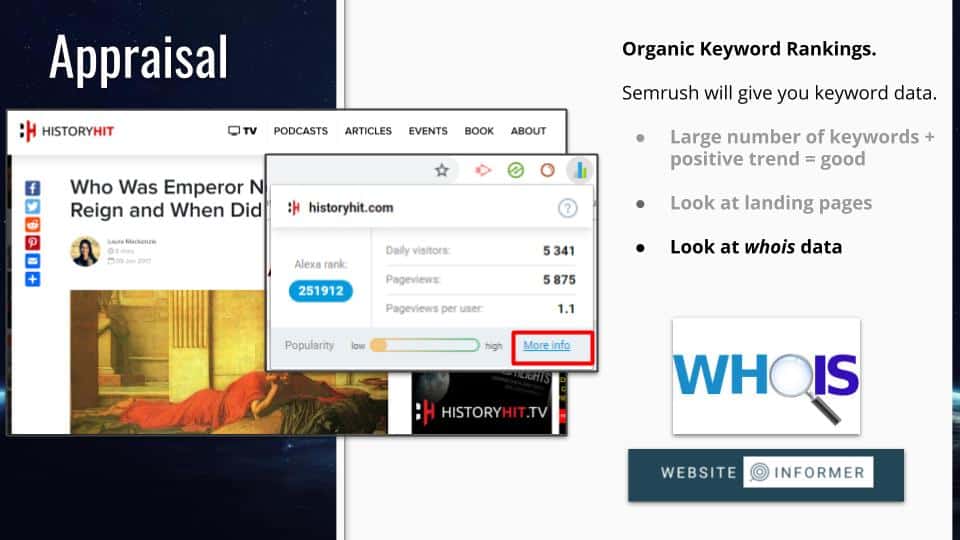

Next, John would use SEMRush to get a good idea of the profile for the site’s organic traffic.

This is how he would see what keywords they ranked for, how many they ranked for, and what percentage of traffic each was responsible for.

He wanted to see a mix of a diverse range of keywords without all the traffic coming from a single page.

He says it is important that all the traffic isn’t to just one landing page (“what if that page drops in rankings?).

He also said it was good to look for sites that were trending upwards, not downwards.

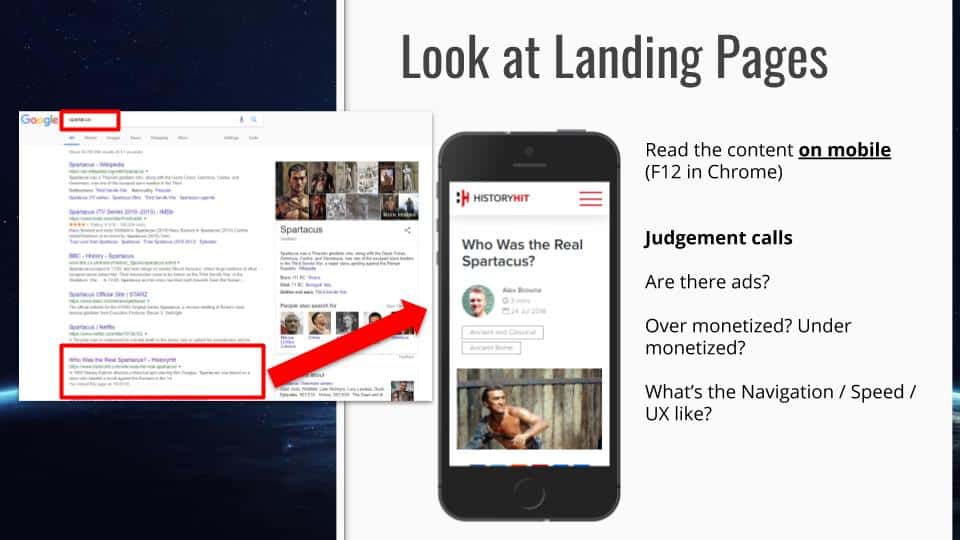

John would then look at their top landing pages and ensure that the keywords associated with the site were keywords that were going to be sustainable or relevant long-term.

Making judgment calls on the site

Once he found a site that passed inspection from SimilairWeb and SEMRush, John said it was important to use some of your experience and common sense to decide if the site was worth pursuing.

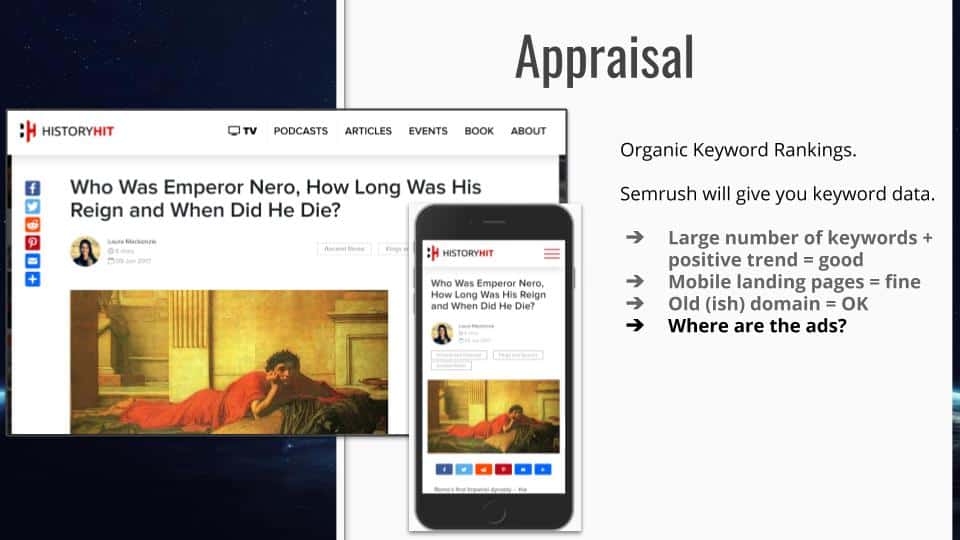

He would try to figure out if there were already ads on the site, how it is currently being monetized, and what opportunities might exist for increasing the revenue on the surface.

He said that he gotta better at this the more he did it.

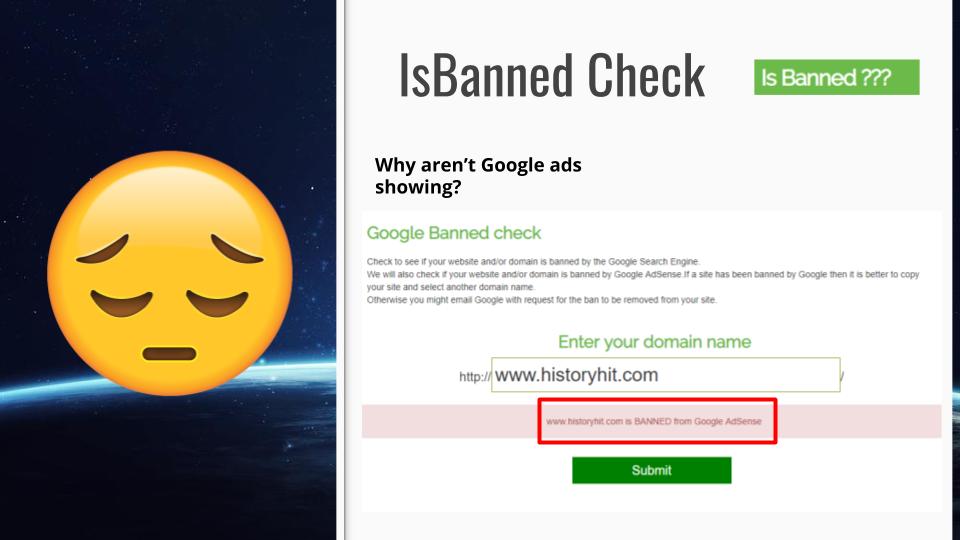

He used this site as an example of one last red flag that should be checked.

This site currently doesn’t have any ads; which means it may be monetizing another way that isn’t apparent… or…

It is banned by Google from using Google ads (Google AdSense or AdX. You can check this here.

He said you could still consider a banned site if you worked with a Google partner and wanted to try to rehabilitate it but that it could be risky in some cases.

In this case, the was indeed banned in AdSense

Once he had all that information, John would then look into details regarding the website owner (in this case, he said we could ignore the site being banned and pretend it wasn’t for the sake of the example).

First, he would look to make sure that the website was independently owned (not by a major media enterprise). Then, he would look at WhoIs info by using Website Informer.

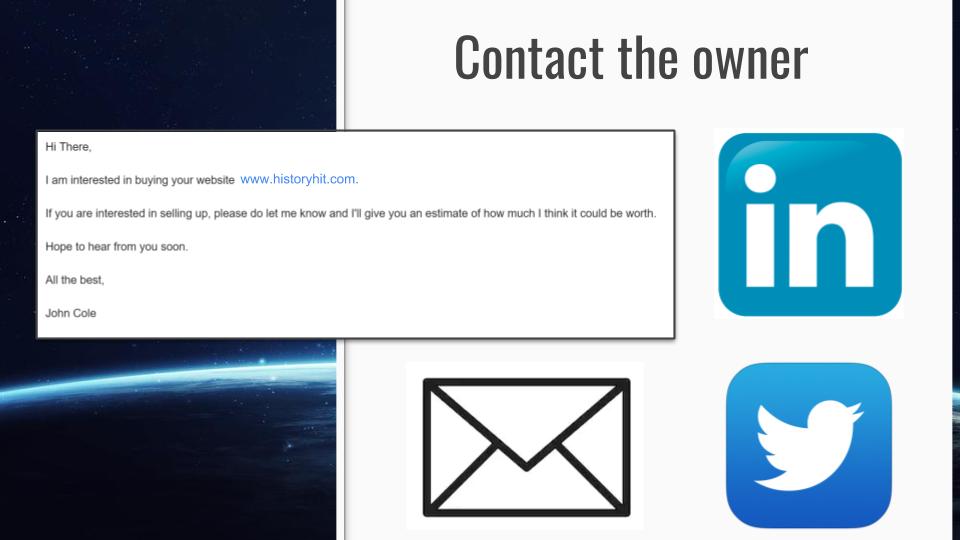

If the site met all the criteria necessary and was independently owned (not owned by someone like, Hearst), John would then begin the process of reaching out.

Usually, he could get the e-mail using the WhoIs database and tool above. Sometimes he would have to use the site’s contact form or LinkedIn.

Contacting the website to do a deal

Next, John had to contact the site owner and try to do a deal.

He shared an example e-mail and some quick tips for establishing credibility and trust. He said that you should keep in mind that you are a random person contacting them over the internet and seek to communicate honestly and openly.

John shared that most publishers actually aren’t interested in selling their sites.

He asked all 100+ people in the room if they would be willing to sell their site if someone reached out to them online. Only a few publishers raised their hands. He used this as an example of how few publishers actually are willing to begin negotiations.

This was his example of why publishers should begin by asking plainly, “are you interested in selling your website”?

Appraising a website’s value

Once he had an interested seller, John cautioned that the process needed to work both ways.

He discussed how it was important for the seller to grant read-only access to their Google Analytics account. If they didn’t have Google Analytics, John warned everyone to be wary.

“…it’s not the fact that they don’t have Google Analytics that should worry you. It’s that you can’t objectively get a feel for where the traffic is coming from or how it has behaved over time” – said John Cole.

John said that you could offer to help them add Google Analytics to their site for a short period of time to get an objective look of the current traffic as a happy medium if they weren’t able to provide access to an existing Google Analytics account.

However, according to Cole, the most important part of appraising a site is understanding it’s traffic sources along with its revenue sources.

This is where all the pitfalls are, said Cole.

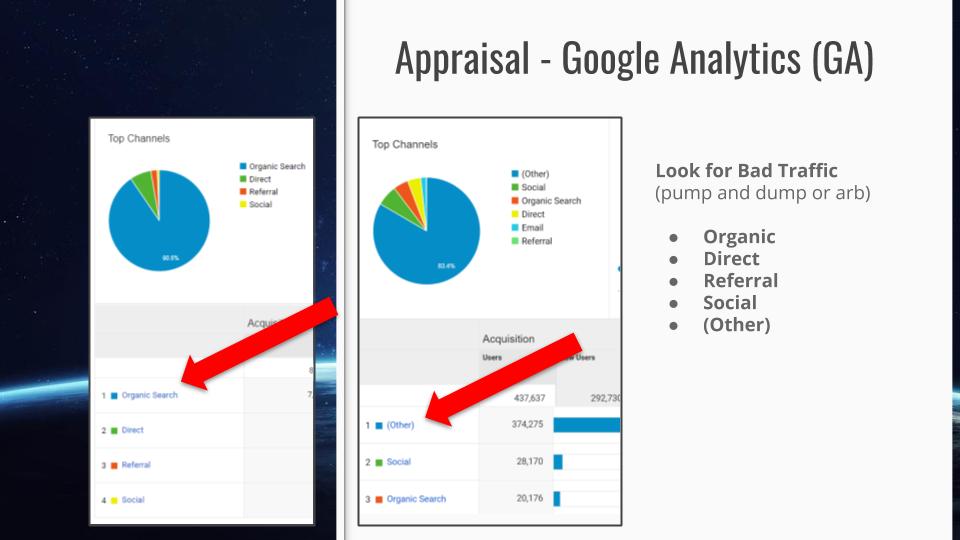

John shared that the image on the left was of a typical “good” evergreen website. Organic traffic from Google is hard to fake long-term and something that can be viewed over time to see how it has been established.

Traffic sources like “direct” or “other” are far more ominous of something that should caution publishers seeking to buy the site. These traffic sources are unknown and could be related to bots or some other form of “pump and dump” scheme designed to take advantage of would-be buyers.

Ultimately, Cole claimed that there were exceptions to every rule but that the most important thing for prospective buyers to be familiar with was the traffic sources and streams of revenue the site currently utilizes.

Cole shared that unknown traffic sources could be from traffic bought from social networks designed to mislead buyers, or that revenue could be from nefarious affiliates that wouldn’t be available once the site changed hands.

To do a deal, Cole claimed that it was vitally important to…

- Check for plagiarism

- Understand where the traffic comes from and what the historical trends and seasonality are

- What the average monthly session earnings are

- And that the current sources of revenue looked like

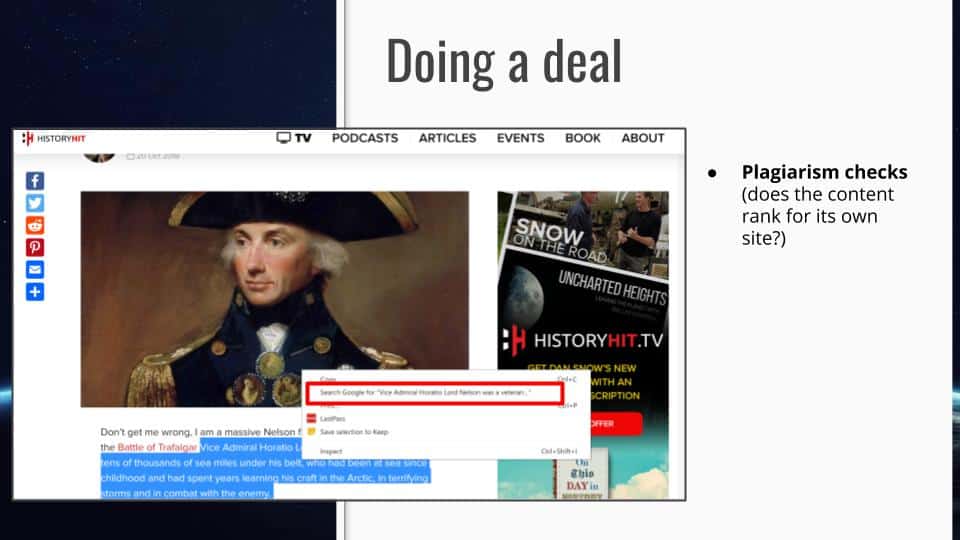

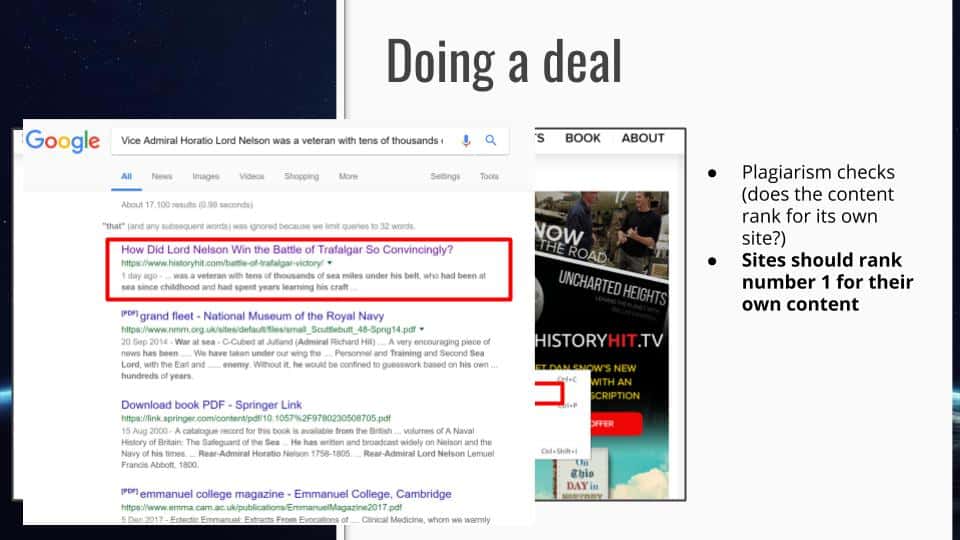

Checking for plagiarism

Websites should always rank number one in search engines for long strings of their own content.

By copy/pasting long sentences from the content of an article into Google search it is easy to see if the publisher is likely the original creator of the content in the article.

If you copy/paste a sentence from a website’s content into Google search and several other articles show-up before the website you’re appraising, that is a red flag that they may not actually have original content.

How to make an offer to buy a website

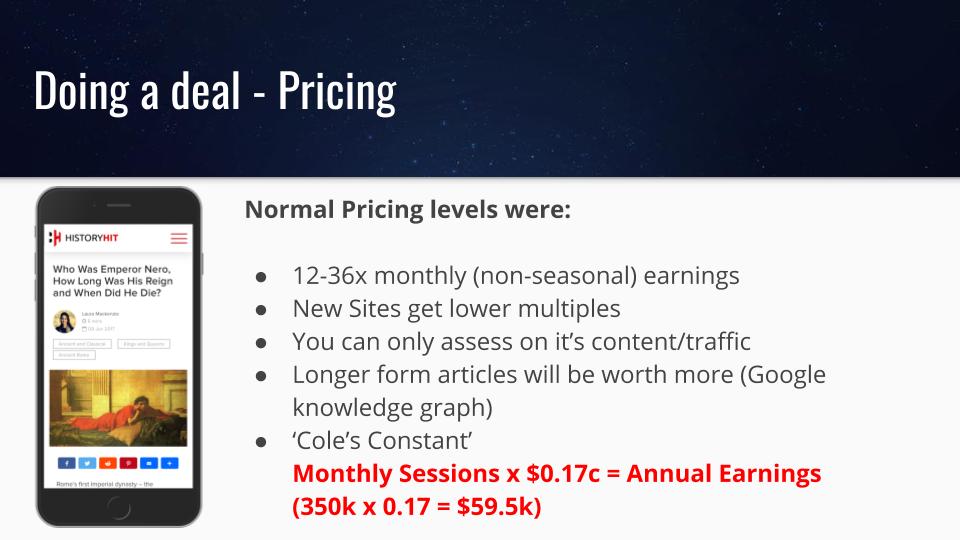

Once you’ve reached this point, it all comes down to establishing fair value, according to Cole. Because of the volatility in this space, it doesn’t make much sense to pay more than a 3 year multiple for a website business unless there is something significant about the opportunity that makes you absolutely sure the ROI will be coming back in less than 18 months.

John ultimately said that it was your job to determine what would allow you to turn a quick profit on the site and the level of effort you’d be willing to put in to ensure the value of the site was achieved.

Lastly, he shared “Cole’s Constant”, a metric designed to generally help an eager prospective buyer give a pricing shot in the dark.

Sometimes, a seller might not be willing to share exact revenue figures or other details and the buyer may have to throw a number out there to get the ball rolling.

John claimed that “Cole’s Constant” was the formula he would use to make blind offers when a seller was tight-lipped about what they were willing to sell their site for.

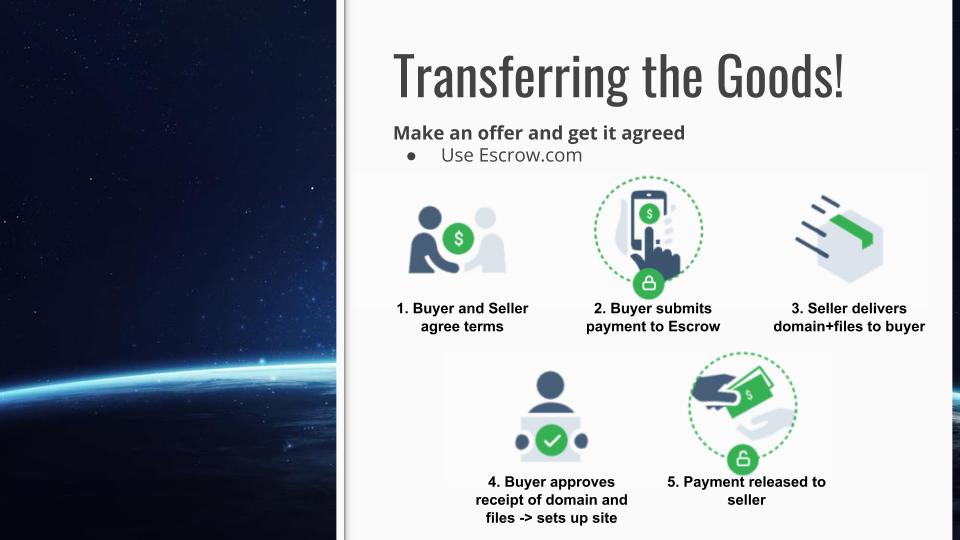

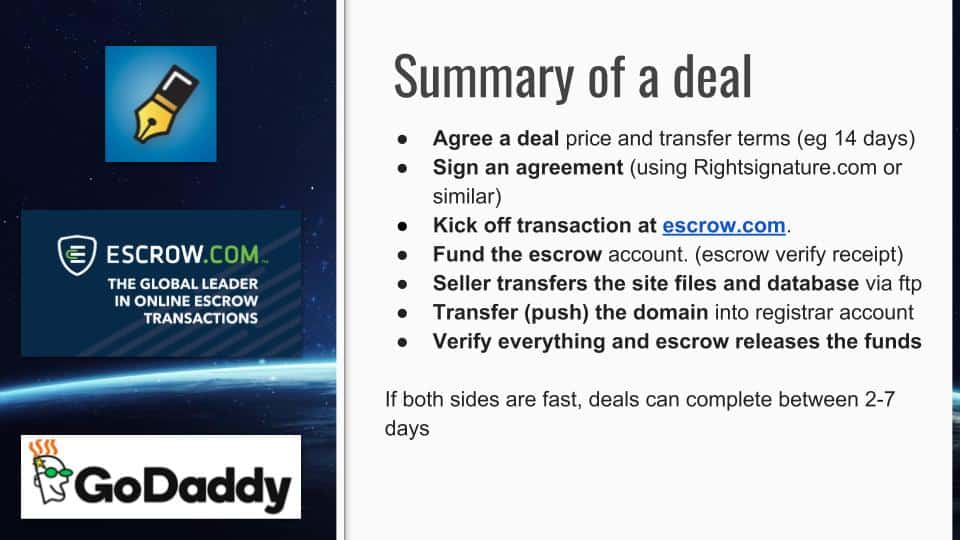

Transferring the website to its new owner

John warned of sketchy online transactions and told everyone in the room to exclusively work through services like Escrow.com.

This is the only safe way to ensure that your money is not delivered to someone who does not fulfill their end of the deal.

John claimed that deals could be done in as little as two days if all parties acted with good faith.

However, Cole warned of several rookie mistakes that most buyers fall prey to at some point.

He said that most disasters could be prevented by proper website appraisal and transactional processes.

Can you profit from buying websites?

Cole provided many success stories from the hundreds of websites that he bought.

He claimed that 33% of the time things went great, 33% of the time things went “OK”, and 33% of the time things went poorly.

Summarizing the presentation

While John was quick to point out that he was not offering investment advice, he did mention that it was one of the questions he was commonly asked by publishers. He claimed that most simply wanted to know if it made sense to invest in digital properties other than their current one.

When done correctly, Cole clearly established that buying websites and turning a profit was not only possible but also a sound investment strategy when proper expertise was applied.

Questions, thoughts? Leave them below and John and I will chime in.